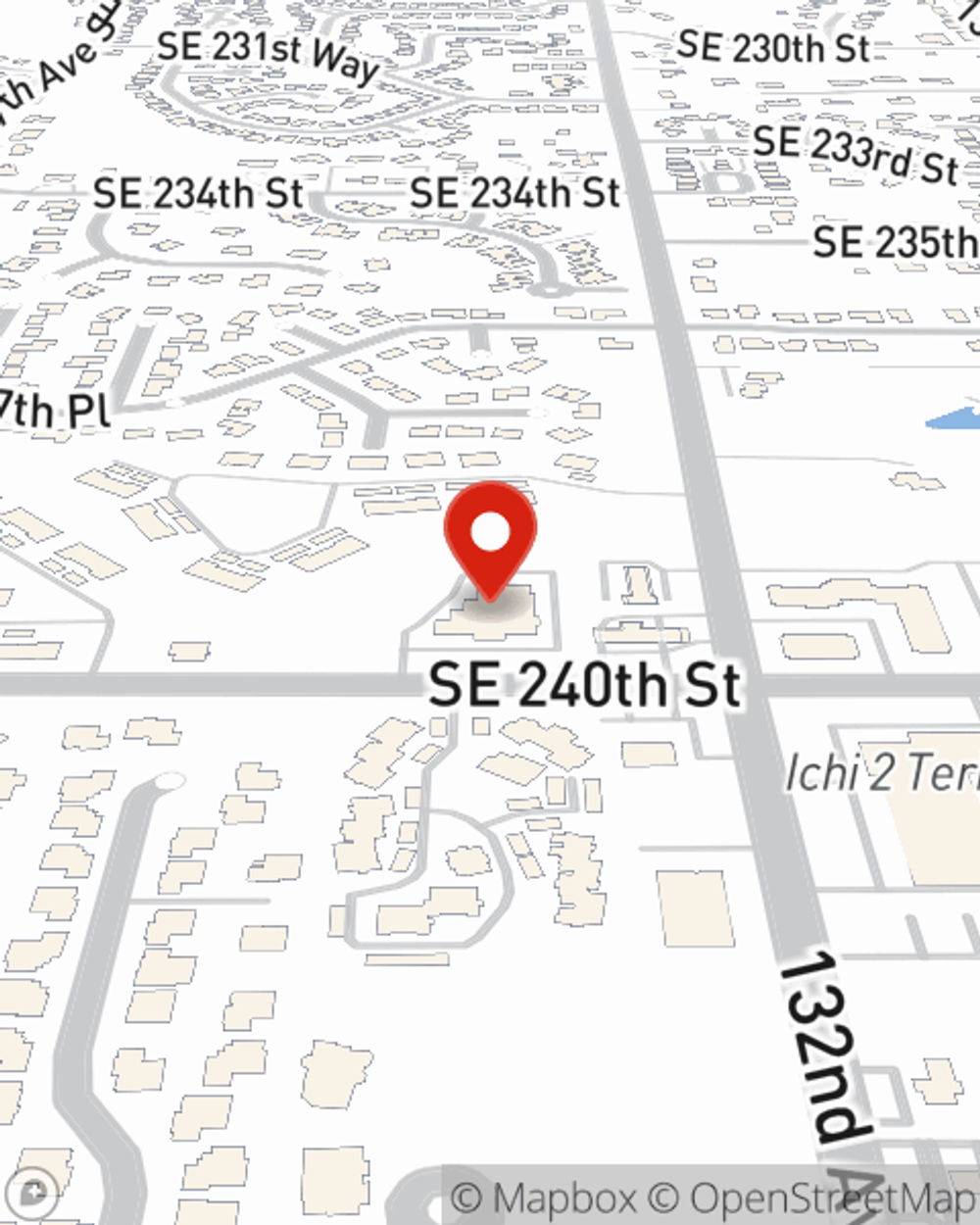

Homeowners Insurance in and around Kent

Protect what's important from the unanticipated.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Insure Your Home With State Farm's Homeowners Insurance

Your house isn't a home unless you're protected with State Farm's homeowners insurance. This terrific, secure homeowners insurance will help you protect what you value most.

Protect what's important from the unanticipated.

Apply for homeowners insurance with State Farm

Don't Sweat The Small Stuff, We've Got You Covered.

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your most personal possessions safe. You’ll get a policy that’s adjusted to match your specific needs. Thankfully you won’t have to figure that out on your own. With personal attention and excellent customer service, Agent Scott Kizer can walk you through every step to provide you with coverage that secures your home and everything you’ve invested in.

Having great homeowners insurance can be invaluable to have for when the unpredictable happens. Call or email agent Scott Kizer's office today to get the home coverage you need.

Have More Questions About Homeowners Insurance?

Call Scott at (253) 398-2746 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Wildfire safety tips: What to do before and after a wildfire

Wildfire safety tips: What to do before and after a wildfire

Learn essential wildfire safety tips to help protect your family and property. Discover how to prepare for wildfires and recover safely afterward.

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.

Scott Kizer

State Farm® Insurance AgentSimple Insights®

Wildfire safety tips: What to do before and after a wildfire

Wildfire safety tips: What to do before and after a wildfire

Learn essential wildfire safety tips to help protect your family and property. Discover how to prepare for wildfires and recover safely afterward.

Can you really save if you choose to bundle insurance?

Can you really save if you choose to bundle insurance?

Bundling insurance, such as auto and home insurance, can be a great way get discounts — but that’s not all! We share some insights about why bundling makes sense for savings and more.